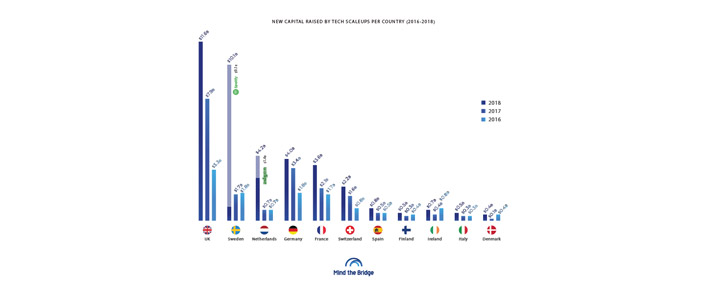

- The Spanish scaleup ecosystem in 2018 still ranks 5th in Europe in terms of the number of scaleups (317 in total), and 6th in the capital raised ($4B in total).

- Though, investing $800M per year, it remains quite far from the top countries in terms of capital invested (Germany, France, and The Netherlands pour around $4B, and Switzerland over $2B).

- However the Spanish ecosystem is still the most performing among the Southern European countries: it hosts 4.5% of the total number of European scaleups, which attracted approximately 3% of the overall capital injected into the European tech scaleup ecosystem: quite a half of the entire Southern Europe area.

- The larger hotspot is Barcelona followed by Madrid, Valencia, Bilbao and Seville+Malaga area.

The Spanish scaleup ecosystem in 2018 still ranks 5th in Europe in terms of the number of scaleups (317 in total), and 6th in the capital raised ($4B in total). Though, investing $800M per year, it remains quite far from the top countries in terms of capital invested (Germany, France, and The Netherlands pour around $4B, and Switzerland over $2B). However the Spanish ecosystem is still the most performing among the Southern European countries.

These are the main highlights from the new Report “Tech Scaleup Spain 2019” realized by Mind the Bridge with the support of ACCIONA, that has been presented this morning in Madrid during the last 2019 Scaleup Summit organized by Mind the Bridge and hosted by Bolsa de Madrid.

“On the bright side, the performance in terms of the number of new scaleups is promising: Spain added 61 new scaleups in 2018, a growth pace that is comparable to Switzerland, The Netherlands, and Sweden - commented Alberto Onetti, Chairman of Mind the Bridge - And we expect the numbers to grow in 2019 by a further 25-30%. Then the Spanish startup ecosystem is vital. But it needs to be supported with more capital.”

Spain definitely outperforms its peers of Southern Europe, effectively being a runner up to the top countries in Europe: Italy in fact ranks 10th, with 208 scaleups and $1.8B capital raised (less than half than Spain), Portugal is 16th (75 scaleups, $0.6B capital), while Greece ranks 18th (48 companies, $0.4B raised). In terms of growth year per year, Spain is comparable to Switzerland (+84 new scaleups), The Netherlands (+66), and Sweden (+53), it’s significantly better than Finland (+37), Italy (+30), and Ireland (+9), while is still very far from the UK (+549), France (+178) and Germany (+119).

In a wider perspective, Spain hosts 4.5% of the total number of European scaleups, which attracted approximately 3% of the overall capital injected into the European tech scaleup ecosystem. This is quite a half of the entire Southern Europe area, once again dragging its feet in the innovation wave with 10% of scaleups (691) and 6% of capital raised ($7.1B) regardless of their 20%+ share in Europe’s GDP ($4,877B vs $22,752) and 22% of population (131M vs 593M). Central States, for example, contribute to 27% of scaleups and 30% of investments, Nordics with 16% and 19%, respectively (despite a relative small size), while British Isles outpaces the rest of Europe with 35% of scaleups and capital raised.

“The Spanish startup ecosystem is definitively thriving. More investments and more connection at pan-European level will help Spain to scale-up.” - added Isidro Laso Ballesteros, Deputy Head of Innovation Ecosystems - European innovation Council (European DARPA) at European Commission.

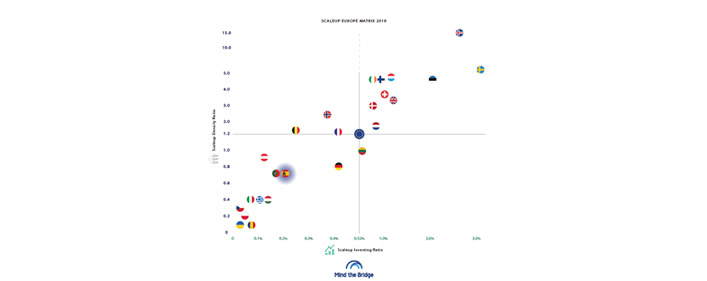

As shown also in the Scaleup Europe Matrix* - aimed at measuring the innovation economy in comparison to the size of the overall economy - Spain, together with all the other Southern European countries, is positioned in the lower left sector which includes those countries that underperform the European average. However, compared to last year, the country increased its density ratio by 0.2 points, from 0.5 to 0.7 scaleups every 100K people. As a consequence, its position moved up, which reflects a consistent, relative increase in the number of scaleups in Spain. Then we can project for Spain a future evolution trajectory towards the center of the Matrix. How much time this process would take would mostly depend on the amount of venture capital poured into the ecosystem.

In addition, the scaleup ecosystem in Spain appears to be of more recent foundation compared to other European countries: 76% of Spanish scaleups were in fact created after 2010 (substantially aligned with the European value of 74%) and 32% between 2014 and 2018.

Almost 70% completed a funding round in the 2015-2018 period, 2015 representing a first inflection point in terms of scaleup financing and 2018 showing a further acceleration, that confirms that it might accelerate again in the upcoming years.

“Spain, as well as most of the Southern and Eastern countries, suffers a chronic situation of relative undercapitalization compared to the other European regions. Unfortunately, there is only medicine to treat such disease: pour more capital. Move the investment bar from hundreds of millions to billions.” - pointed out Arantza Ezpeleta Puras, General Manager of Technology and Innovation at ACCIONA.

Investments in Spain

The vast majority of the capital raised in Spain ($3.4B, 84% of total) comes from Venture Capital funds and Angels. $0.5B (14% of total) was raised on the stock markets, though no tech IPOs have been recorded in 2018. $64M (less than 2%) were on the other hand raised by Spanish scaleups through ICOs, all in 2018.

Focusing on tech scaleups, Mind the Bridge research shows that 32% ($1.1B) of all VC investments poured into Spanish scaleups comes from domestic investors (4% higher than the European average). 17% comes from other European investors (7% of which from UK, equal to $0.2B), 60% comes outside Europe (32% from US, 10% from Japan and 9% from the Rest of the world).

Spain hosts a total of 33 (10.4% of the total) dual companies - scaleups that, shortly after inception, move their HQs abroad, while keeping relevant operations in their country of origin - that cumulatively secured over $0.8B (20% of the total capital raised). They raised more than double the capital raised by scaleups that pursued a local funding strategy ($24.6M on average versus $11.2M). 23 out of 33 choose the US as their destination - 14 of them (61%) opted for Silicon Valley, with a preference for San Francisco (6) - while 3 went to London.

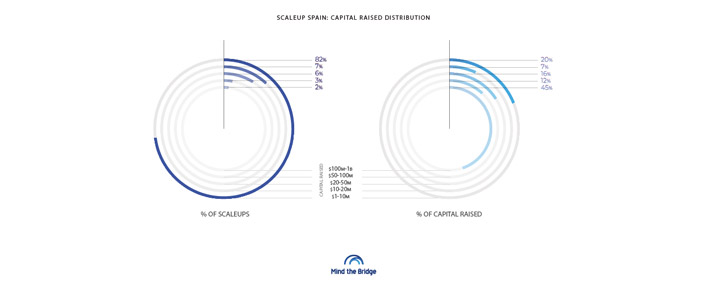

The Spanish scaleup ecosystem is mostly made up of small scaleups. 82% have raised between $1M and $10M, though they have secured only 20% of the total capital made available to Spanish scaleups. 16% raised between $10M and $100M (the so called “The “middle class” segment) and raised 35% of the total amount of capital. Only 2% are “Scalers”, i.e. they have been able to raise over $100M, eating about half (45%) of the total capital.

If we look at the industries, the Spanish scaleup scene appears to be dominated by more “traditional” tech industries: 14% (45 in total) provide E-Commerce services and products, Fintech follows with 10% (32) and, consistently with the centrality of the tourism industry in Spain and the presence of incumbents such as Amadeus, Traveltech ranks 3rd with 8% (25).

In Spain the “Network Effect” contributes to Scaleup Concentration: the larger hotspot is Barcelona (155 scaleups, 49% of total) and $2.4B in capital raised (59% of total); Madrid follows with 110 (35% able to raise 34% of capital available); Valencia ranks 3rd with 15 ($0.1B) followed by Bilbao (5 scaleups) and the Seville+Malaga area (5).

*Methodology (for a complete list, please see the full Report)

- “Startup” <$1M funding raised

- “Scaleup” >$1M funding raised

- “Scaler” >$100M funding raised

- “Super Scaler” >$1B funding raised

“Dual Companies” > Startups founded in one country that relocated their headquarters – and with that part of their value chain – abroad, while maintaining a strong operational presence in their country of origin. - “Scaleup Density Ratio”

Number of scaleups per 100K inhabitants. A measure of density of scaleups in a given ecosystem. - “Scaleup Investing Ratio”

Capital raised by Scaleups as a percentage of GDP. A measure meant to measure the capital invested in scaleups in a given ecosystem, compared to the size of the overall economy of that country. - “Scaleup Country Index”

Country ranking built upon Scaleup Density Ratio and Scaleup Investing Ratio. A measure of the overall innovation commitment of a given ecosystem and its ability to produce significant tech players. - “Scaleup (City) Hub Index”

Hub ranking built upon Scaleup Density Ratio and Scaleup Investing Ratio. A measure of the overall innovation commitment of a given city/tech hub and its ability to produce significant tech players. - “Scaleup Matrix”

The matrix visually compares ecosystems by factoring the Scaleup Density Ratio and Scaleup Investing Ratios.